Threshold Income Definition Hmrc . Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to. Web what is the difference between adjusted income and threshold income? Definitions of adjusted income and threshold income are. Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web what is the tapered annual allowance. Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus.

from www.media4math.com

Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web what is the difference between adjusted income and threshold income? Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to. Web what is the tapered annual allowance. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Definitions of adjusted income and threshold income are.

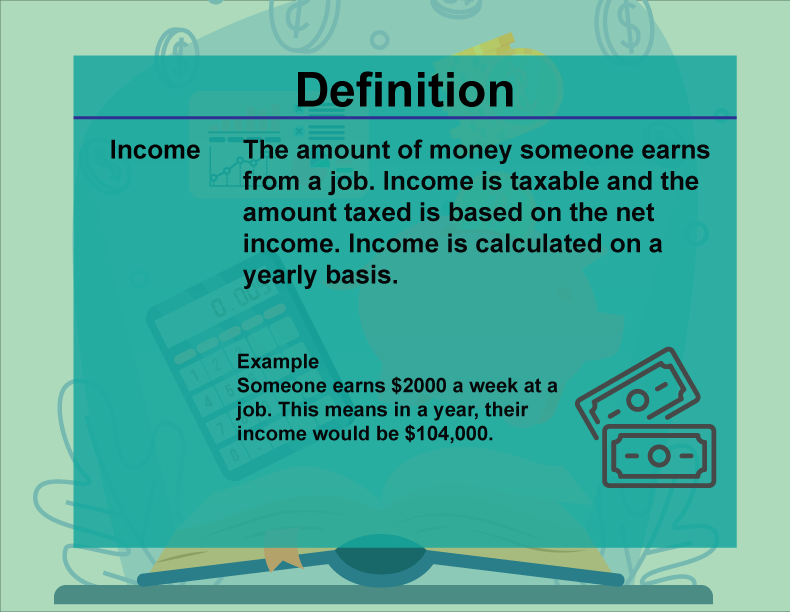

DefinitionFinancial Media4Math

Threshold Income Definition Hmrc Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web what is the tapered annual allowance. Definitions of adjusted income and threshold income are. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web what is the difference between adjusted income and threshold income? Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to.

From www.studypool.com

SOLUTION Taxation Gross Definition Calculation on Physical Threshold Income Definition Hmrc Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to. Definitions of adjusted income and threshold income are. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes). Threshold Income Definition Hmrc.

From www.financestrategists.com

Discretionary Definition, Factors, and How to Manage It Threshold Income Definition Hmrc Web what is the difference between adjusted income and threshold income? Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to. Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Section 228za and paragraph 8 (1) schedule 34 finance act 2004.. Threshold Income Definition Hmrc.

From cryptotaxcalculator.io

How to report your crypto taxes to the HMRC Threshold Income Definition Hmrc Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web what is the tapered annual allowance. Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit. Threshold Income Definition Hmrc.

From www.simmons-simmons.com

Autumn Statement 2022 HMRC tax rates and allowances for 2023/24 Threshold Income Definition Hmrc Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Definitions of adjusted income and threshold income are. Web what is the difference between adjusted income and threshold income? Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more. Threshold Income Definition Hmrc.

From sageco.co.uk

HMRC releases more details MTD for Tax Sage Threshold Income Definition Hmrc Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Definitions of adjusted income and threshold income are. Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web what is the difference between adjusted income and threshold income? Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is. Threshold Income Definition Hmrc.

From www.pelajaran.guru

Hmrc Tax Rates 2023 2024 PELAJARAN Threshold Income Definition Hmrc Web what is the difference between adjusted income and threshold income? Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Definitions of adjusted income and threshold income are. Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web your ‘threshold income’ is above. Threshold Income Definition Hmrc.

From waterintucson.com

Water in Tucson Threshold Income Definition Hmrc Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web what is the tapered annual allowance. Definitions of adjusted income and threshold income are. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web broadly, threshold income. Threshold Income Definition Hmrc.

From inspire.accountants

The top 9 Tax Planning strategies for High Employees Inspire Threshold Income Definition Hmrc Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web what is the tapered annual allowance. Definitions of adjusted income and threshold income are. Web what is the difference between adjusted income and threshold income? Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web the tapered annual allowance applies. Threshold Income Definition Hmrc.

From en.econostrum.info

Changes to Child Benefit and the High Threshold from April 6th Threshold Income Definition Hmrc Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web what is the tapered annual allowance. Definitions of adjusted income and threshold income are. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see. Threshold Income Definition Hmrc.

From tax.modifiyegaraj.com

Uk Tax Calculator 202223 How To Calculate Your Taxes With Hmrc TAX Threshold Income Definition Hmrc Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web what is the tapered annual allowance. Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web what is the difference between adjusted income and threshold income? Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering. Threshold Income Definition Hmrc.

From www.gov.uk

How low is measured in households below average GOV.UK Threshold Income Definition Hmrc Web what is the difference between adjusted income and threshold income? Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Definitions of adjusted income and threshold income are. Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000,. Threshold Income Definition Hmrc.

From ourworldindata.org

Threshold or consumption for each decile Our World in Data Threshold Income Definition Hmrc Web what is the tapered annual allowance. Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web what is the difference between adjusted income and threshold income? Section 228za and paragraph 8 (1) schedule 34 finance act 2004. Web broadly, threshold income is your total taxable income plus any. Threshold Income Definition Hmrc.

From www.taxsey.com

Gross Total Threshold Income Definition Hmrc Web what is the tapered annual allowance. Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Definitions of adjusted income and threshold income are. Web unfortunately, hmrc’s definitions of adjusted and threshold. Threshold Income Definition Hmrc.

From www.financestrategists.com

Taxable Definition, Components, & Formula Threshold Income Definition Hmrc Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web what. Threshold Income Definition Hmrc.

From cheneypayrollservices.co.uk

HM Revenue and Customs News UK Tax Rates and Bands 2017/18 Cheney Threshold Income Definition Hmrc Web the tapered annual allowance applies if threshold income is more than £110,000 and adjusted income is more than £150,000. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of.. Threshold Income Definition Hmrc.

From quizlet.com

circular flow of Diagram Quizlet Threshold Income Definition Hmrc Web between 6 april 2020 and 5 april 2023, “threshold income” was £200,000, “adjusted income” was £240,000 and. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web what is the tapered annual allowance. Web the tapered annual allowance applies if threshold income is more than. Threshold Income Definition Hmrc.

From www.gatwickaccountant.com

How to Pay HMRC Self Assessment Tax Bill in the UK Threshold Income Definition Hmrc Definitions of adjusted income and threshold income are. Web what is the tapered annual allowance. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web broadly, threshold income is your total taxable income plus any salary/bonus sacrificed for pension contributions, minus. Section 228za and paragraph 8. Threshold Income Definition Hmrc.

From www.youtube.com

National Definition, Concept GDP, GNP, NNP UPSC/ State PSC Threshold Income Definition Hmrc Web your ‘threshold income’ is above £200,000, and your ‘adjusted income’ is above £260,000 (this threshold increased to. Web unfortunately, hmrc’s definitions of adjusted and threshold income (see tapering of annual allowance for high incomes) tend to cause a bit of. Web what is the tapered annual allowance. Definitions of adjusted income and threshold income are. Web the tapered annual. Threshold Income Definition Hmrc.